food tax in maryland

In Maryland beer vendors are responsible for paying a state excise tax of 009 per gallon plus Federal excise taxes for all beer sold. This page describes the taxability of food and meals in Maryland including catering and grocery food.

Film And Tv Production In Usa In Details Tv Film Movie Usa Houseofcards Creativeindustries House Of Cards Creative Economy Cards

Counties and cities are not allowed to collect local sales taxes.

. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Code Tax-General 11-206. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency.

We would like to show you a description here but the site wont allow us. In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and is not a taxable prepared food. A grocery or market business is considered substantial if sales of grocery or market food items total at least 10 percent of all sales of food.

This would be on top of the 20 million Maryland pet owners paid in the sales tax on pet food last year. A cottage food business or a home-based business is defined in the Code of Maryland Regulations COMAR 10150 3 as a business that a produces or packages cottage food products in a residential kitchen. Larry Hogan and leaders in the legislature have reached a 186 billion agreement for tax relief over five years for retirees small businesses and low-income families officials.

02333gallon tax in Garrett County. In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and the food is not a taxable prepared food. Groceries and prescription drugs are exempt from the Maryland sales tax.

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. All sales of food and beverage are subject to the tax except the following cases. We support the program and think there are fairer ways to raise money than a new tax on responsible pet owners.

Sale of beer wine and distilled spirits for OFF PREMISES consumption. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland FoodBeverage Tax. For example if I go grocery shopping will there be a tax rate.

The goal is to fund a state spayneuter program. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. 27 This credit is available to Idaho residents.

A Montgomery County Maryland FoodBeverage Tax can only be obtained through an authorized government agency. There is a proposal to create a new 1 million tax on pet food in Maryland. This is why you wont have to pay a Maryland food tax on a box of crackers.

2022 Maryland state sales tax. To offset the cost of grocery sales taxes paid by lower-income consumers Idaho offers a grocery credit which may be claimed on a taxpayers state income tax return of 100 per individual under the age of 65 including dependents and 120 per individual for residents age 65 and older. However if a grocery store that falls under this category sells prepared foods that can be consumed on the premises or carried out then you will most likely pay a 6 sales tax.

Maryland Beer Tax - 009 gallon Marylands general sales tax of 6 does not apply to the purchase of beer. B Three states levy mandatory statewide local add-on sales taxes. Sale of candy or confectionery.

Information About Sales of Food. Maryland Salary Tax Calculator for the Tax Year 202122. Our calculator has been specially developed in.

You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202122. And b has annual revenues from the sale of cottage food products in an amount not exceeding 25000. California 1 Utah 125 and Virginia 1.

We include these in their state sales. This thread is archived. Posted by 7 months ago.

If you should have any questions please contact the Office of Food Protection at 410 767-8400. Does anyone know what items arent taxed here in MD. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Montgomery County Maryland FoodBeverage Tax.

Exact tax amount may vary for different items. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Made by a cottage food business that is not subject to Marylands food safety regulations It is our intention that each approving authority will enforce and regulate these business consistently and uniformly as stated in the regulations.

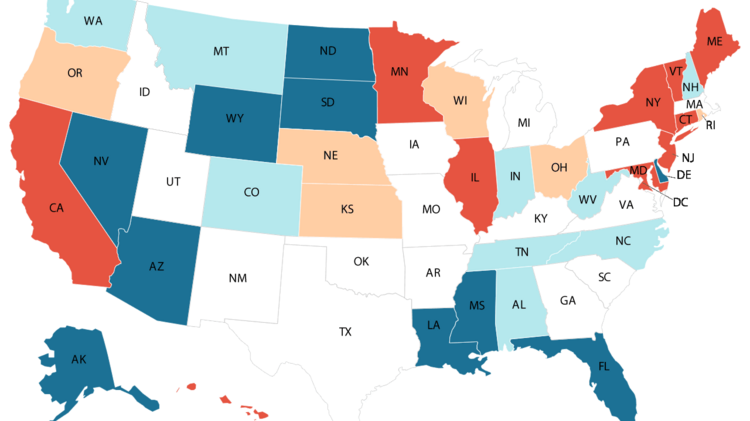

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Is the food taxed here in Maryland. To learn more see a full list of taxable and tax-exempt items in Maryland.

However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a 6 sales tax.

Mpmpmom And Pops Reprint Menu1 Pop

Kroger Private Selection Maryland Style Crab Cakes Crab Cakes Crab Cake Sliders Baked Fries

National Bohemian Bock Beer Baltimore 38 800 Antique Beer Labels Old Beer Cans Wine And Beer

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

Maryland Sales Tax Free Week 2015 When What Qualifies School Essentials Tax Free School Diy

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

Pin By Santainc On Amazing Infographics Infographic Bits And Bobs New Hampshire

Postcard Promoting One Week Of Maryland Shopping With No Sales Tax On Qualifying Clothing Or Footwear Priced 100 Or Less Sales Tax Shopping Postcard

Source White House Office Of Management And Budget The Post Income Tax Budgeting Receipts

20 Delicious And Iconic Maryland Foods Recipe Icon Delicious Food

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nonprofit 501 C 3 Articles Of Incorporation How To Write With Sample Non Profit Writing Articles

It S Tax Free Week In Maryland Now Through The 18th Shop Tax Free At All Your Favorite Shops Make Sure You V Candy Companies Candy Store Old Fashioned Candy

Thank You For Your Support Letter Check More At Https Nationalgriefawarenessday Com 23334 Thank You F Appreciation Letter Support Letter After School Program

Fritters At Wit Wisdom In Baltimore Maryland Food Wit Wisdom Baltimore Maryland

Women 6 5 Inch Phone Cute Milk Box Casual Crossbody Bag Milk Box Cute Pink Chocolate